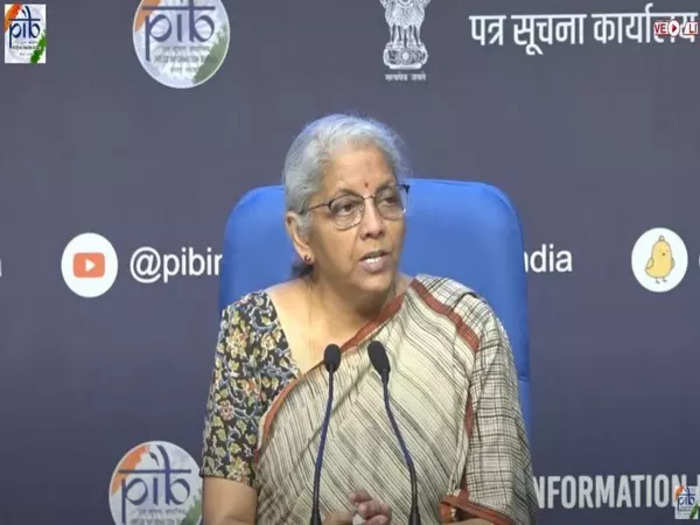

The GST Council will discuss rationalizing tax rates next month i.e. in September. Finance Minister Nirmala Sitharaman gave this information on Tuesday. The Finance Minister, however, also said that the final decision on the change in tax and slabs will be taken later. The Finance Minister also said that compensation cess on other issues including luxury goods will also be discussed. According to PTI news, a group of ministers (GoM) on rationalizing tax rates headed by Bihar Deputy Chief Minister Samrat Chaudhary met last week. It was broadly agreed to keep the slabs under Goods and Services Tax (GST) unchanged at 5, 12, 18 and 28 percent.

The final decision will be taken in the next meeting

According to the news, the panel also entrusted the Fitment Committee—a group of tax officials—with the task of analyzing the implications of changes in rates on some items and presenting them before the GST Council. Sitharaman said that in the upcoming GST Council meeting, the committee of officials will make a presentation on rationalizing the rates. However, she said that the final decision on rationalizing the rates will be taken in the next meeting. The 54th meeting of the GST Council, chaired by the Union Finance Minister, will be held on September 9, in which state ministers will participate.

This thing came to the fore regarding Karnataka

In the 53rd meeting of the GST Council on Saturday, it was learned that Karnataka had raised the issue of levying compensation cess, repayment of loan amount and its further steps. Officials had earlier said that the government may be able to repay the Rs 2.69 lakh crore borrowing taken in FY 2021 and 2022 to compensate the states for GST revenue loss by November 2025, four months before the scheduled March 2026. Therefore, how the cess amount will be divided beyond November 2025 can be discussed in the council meeting. The compensation cess was initially introduced for 5 years to meet the revenue shortfall of the states after the implementation of GST.

Use of funds collected through the levy

The compensation cess expired in June 2022, but the funds collected through the levy are being used to repay interest and principal of Rs 2.69 lakh crore borrowed by the Centre during Covid-19. The GST Council will now have to decide on the future of the existing GST compensation cess with respect to its name and the modalities of its distribution among the states after the loan is repaid. To meet the resource gap of the states due to the release of less amount of compensation, the Centre borrowed and released Rs 1.1 lakh crore in 2020-21 and Rs 1.59 lakh crore in 2021-22 as back-to-back loans to meet a part of the shortfall in cess collection. In June 2022, the Centre extended the recovery of compensation cess till March 2026.